Mango Chutney and the retirement spending conundrum…

- tfpfinancialplanning

- Jul 23, 2024

- 2 min read

I know you’re thinking what does Mango Chutney have to do with retirement spending?

I promise I will get to that and there is an important point, but first…

Turning left

Debating the value of turning left on a plane is a common conversation with our clients.

Is it worth spending so much more than the price of a normal ticket to travel on the same plane ending up at the same place? Just for a good night’s sleep, better food and champagne!

Ultimately this is a personal choice because if it were purely about price the decision most people would make is it isn’t worth the additional money.

But this is about more than the cost of a plane ticket.

For some people turning left is an aspiration, a desire to experience something different that they have always dreamt of.

It’s not about the cost, because we all know it is expensive.

The Dilemma

The challenge in my experience most people struggle with is justifying the comparable cost. Is it worth spending £000’s extra for a good night’s sleep?

Unfortunately, there isn’t a right answer, magical equation or expert opinion.

It also doesn’t have to be about “turning left”, you could apply this to any other luxury in life that has a big price tag especially where there is a cheaper and very similar option.

This is where the Mango Chutney comes in… I heard a story about a lady in her late 80’s.

Every week during the weekly Tesco shop she considers spending an extra £1 on the luxury (Tesco finest) Mango Chutney. And every week, she decides to buy the cheaper option.

She can afford the more expensive option. In fact, she can also afford to turn left on a plane.

But she is content with this decision and says “after a lifetime of thinking about how much money I am spending, I just can’t change”

These are habits of a lifetime, very hard to change and not always necessary to do so.

Retirement Wisdom

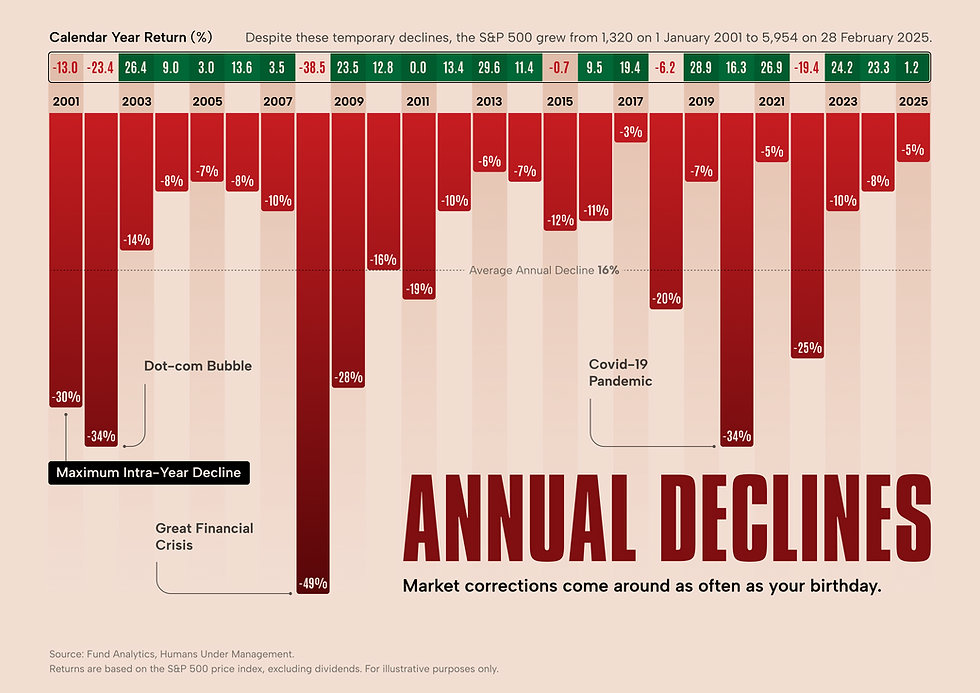

The challenges of spending money in retirement are underrated.

Especially, when you might need to change a lifetime of habits, you are worrying about running out of money and you are depleting a pot of money you have spent a lifetime accumulating.

Start with establishing what is truly important to you, NOW at this phase of your life.

Work out what is going to make you happy before thinking about price and comparison.

This will help you spend enough money on those things that matter most before it’s too late.

This sounds easy, but in my experience, it’s not.

Remember Life is Not a Rehearsal, and you might decide that an extra £1 on Mango Chutney is worth it! (or even turning left on a plane!)

Comments